.png)

In September, we hit 2 billion successful mobile money transactions. That’s 2 billion times someone has used their phone to make or receive a payment through pawaPay.

It took over four years to reach our first billion; the second came in under twelve months 🤯

We also crossed €7 billion in total payments settled.

This scale is a result of building a reliable and secure platform designed to handle growing volumes and onboarding new merchants with ease. For merchants, this means continued reliability and investment in making every transaction count.

We’ve launched remittances as a new payment flow in Congo-Brazzaville and Uganda, both fully live with MTN and Airtel. This marks the start of our cross-border payments journey — more markets coming soon.

Ready to go cross-border? Speak to your Account Manager or contact our Sales team.

Ethiopia is one of Africa’s fastest growing mobile money markets — with over 120 million people, 61 million mobile money users, and more than €215 billion in annual transactions.

We’ve received our INSA (Information Network Security Administration) certification, a key step toward launching payments in Ethiopia. This certification confirms that our systems meet Ethiopia’s security and data-handling standards — an essential requirement for operating in the market.

We’re now piloting transactions and finalising our commercial license, paving the way for merchants to access one of Africa’s most promising payments markets.

👉 Get in touch with your Account Manager or contact our Sales team to learn more.

We’ve greatly improved reconciliation times across all markets, meaning merchants now get highly accurate payment statuses faster than ever in the pawaPay Dashboard.

Behind the scenes, we’ve optimised how payments are reconciled — cutting average delays by more than 30 minutes, and by over 60% with some providers.

Faster reconciliation means you can confirm payments sooner, release goods or credit accounts without delay, and spend less time checking for updates.

We’ve expanded and improved our direct integrations across key markets — adding IMT (remittance) support and enhancing connections with MTN MoMo (Cameroon, Congo, Uganda, Zambia, Benin), Airtel COD and Vodacom Tanzania.

We’ve also improved reliability and performance with partners like Monnify and GIMAC, helping merchants process payments faster, and with fewer interruptions.

We’ve added USSD collections in Nigeria — helping merchants reach more customers, and making it easier for their customers without data or smartphones to pay.

We also enhanced our reconciliation engine to support this new channel.

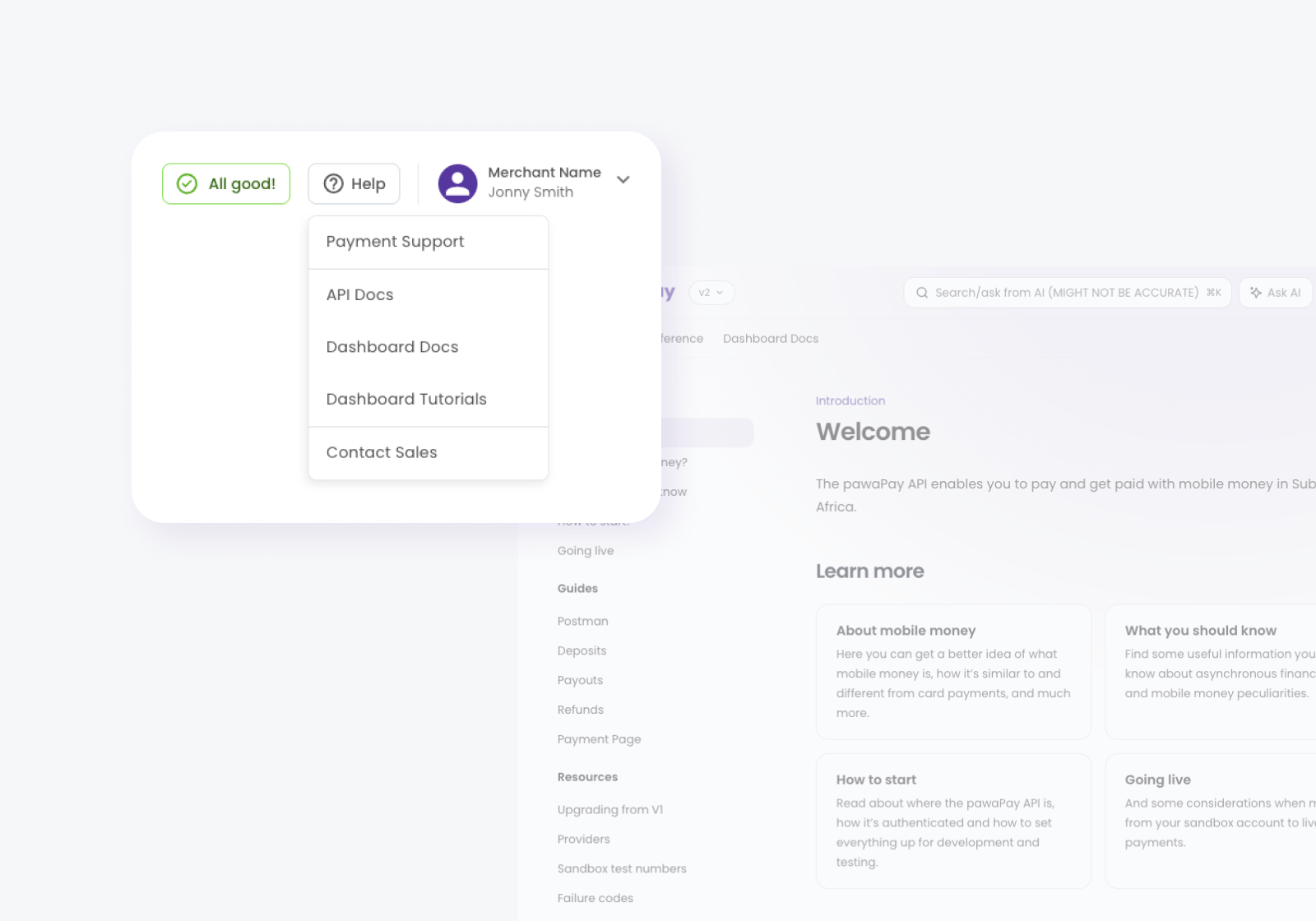

We want new merchants to have a great experience when creating an account, so we’ve made the email sign up flow faster and clearer — reducing steps and improving communication throughout.

We’ve also introduced a new, built-in Merchant Terms of Service flow that’s faster and more intuitive.

Together, these make getting started with pawaPay simpler and smoother — with more onboarding improvements coming soon!

We’re building a new Top ups feature that lets merchants request and track wallet funding directly from the pawaPay Dashboard — no more manual messages or requests.

You’ll be able to:

This feature will remove the need for manual wallet top up requests through our support widget and make funding visibility simpler and faster — all in one place. We’ll keep you posted 👀

Our Provider Prediction API helps payments reach the right destination by identifying which provider a phone number belongs to.

It’s now smarter and self-learning, and gets more accurate over time. It now uses past results to avoid repeating known failed predictions and includes better fallback handling when a match isn’t clear.

This means fewer failed payments, fewer customer retries, and a smoother experience for both merchants and your customers.

A new Statements API will let you automatically generate and download wallet statements, helping you streamline reconciliation and reporting.

You’ll be able to:

This means faster, automated reconciliation and better visibility across your operations.

We’re also optimising statement generation in the pawaPay Dashboard so exports will process significantly faster, giving you quicker access to your data with less time spent waiting.

Your statements will be easier to access and faster to generate, whether you use the pawaPay Dashboard or the API.

Our infrastructure has kept payments running with 100% uptime since December 2024 — processing nearly 1 billion transactions without disruption. That means merchants have experienced uninterrupted service and consistent reliability, even during peak periods.

Thanks for reading — and helping us on our mission to connect the world to one billion consumers in Africa!

Payments don’t have to suck!

As we wrap up 2025, we’re celebrating a year of major progress across the pawaPay platform — all focused on helping merchants process payments more reliably, scale faster, and spend less time on operations.

Read more

We've partnered with Airtel Money Africa — connecting International Money Transfer operators to 161m+ wallets for faster, more reliable cross-border payments in seven African markets.

Read more

Closing in on 2 billion transactions, a new V2 API, new market updates, adding more Scheduled Settlements corridors, and easier KYB onboarding — here’s a quick look at what’s new and what’s coming next.

Read more